SBI Wealth brings to you an exclusive Digital Enabler featuring:

* Gateway to invest in a host of Mutual Funds and Investments

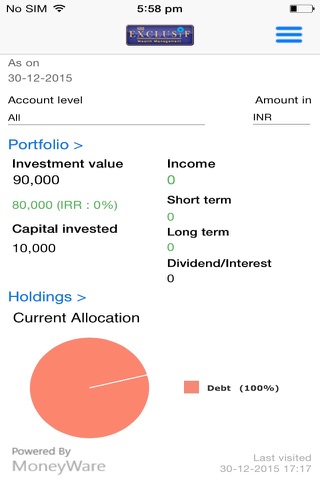

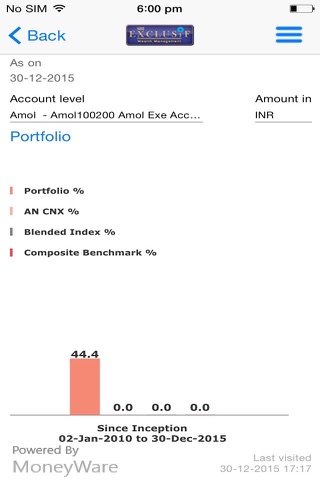

* 360° view of MF and Investment Portfolio

* Open New Folio, SIP, Purchase, Redeem, Switch and more

* Get Report on Holdings, Transactions, Gain & Loss

Value Proposition

Personalized Banking and Benefits

* A dedicated and experienced Relationship Manager (RM) through

SBI Wealth Hubs and e-Wealth Centre

* Waiver on a host of Service Requests

* Discount on Locker Rentals

* Unlimited free transactions through other Bank ATMs

* Door-Step Banking – Customer Relationship Executives available for pickup & delivery of documents to save the hassles of travel/visits

Investment & Other Products

* Unbiased Open Investment Platform

* Experienced Research Team and Investment Counsellors

* Best in Class Investment Products across various Asset Classes

* Direct Equity and Fixed Income Services through our partners

* Protection Solutions in the form of Life & General Insurance

* “SBI Wealth Investment Outlook” – Monthly Research report for our Clients

Digital Convenience

* Future-ready Internet Banking Client Portal

* Mobile App which enable Transactions, Portfolio Review & Tracking at your fingertips

* Remote Relationship Management Centre i.e. e-Wealth Centre, providing:

> Extended Banking Hours 8:00 am to 10:00 pm

> Voice and Video Calling with e-RM

> Services to Wealth Clients onboarded from non-SBI Wealth Hub Centres called “Satellite Wealth Hub Centres” through e-Wealth Centres

Lifestyle Benefits

* Complimentary Visa Signature Debit Card that offers discounts across various categories

* Visa Signature Credit Card that brings access to Priority Pass membership, Concierge Services and much more

* SBI Rewardz Loyalty Program with 5x Reward Points

* Reward Points redemption across a large array of Products and Services including Online & In-store shopping